Loan in Nigeria, grants in Nigeria, quick loans in nigeria

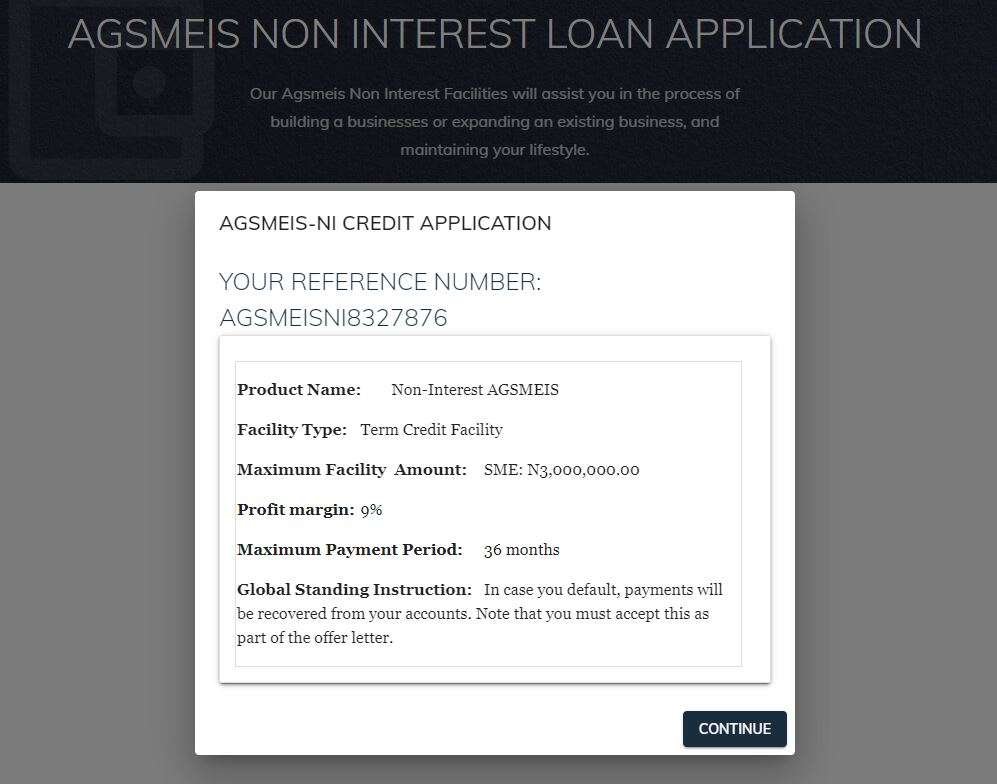

The Central Bank of Nigeria is giving non-interest which is also collateral-free. Individuals can get up to N3,000,000 to small business owners in a scheme under AGSMEIS which is known as Agric-Business/Small and Medium Enterprises Investment Scheme.

Also read: How to get Grants And Loans in Nigeria in 2022

What Businesses/Sectors Are Eligible For the NMFB Loan

- I.C.T

- Telecommunications

- Media

- Creative Industry

- Agriculture & Agro-allied Processing

- Art & Entertainment

- Automobile Services

- Fashion and Dressmaking

- Catering & Event Management

- Courier & Delivery Services

- Apparels and Textiles

- Cottage Industry

- Publishing

- Hospitality

- Health Services

- Kerbs and Electric Pole making

- Welding and fabrication

- Animal Husbandry

- Cosmetics, Beauty, and Makeup Artistry

- POP and Tiling

- Carpentry

- Masonry

- Electrical and Electronics

Also read: Top Business Auto Loans in 2022

NMFB Loan Modalities – loan in Nigeria

The scheme Financing would be for start-ups, business expansion, or revival of weak companies. The terms of the NMFB loans are stated below;

- Loan amount: Up to N3,000,000

- Interest: 5% per annum for regular and 0% for non-interest AGSMEIS

- Moratorium: Maximum of 18 months for principal and 6 months on interest.

- Tenor: Up to 7 years (depending on nature/gestation period of the project)

To get the AGMEIS loan, the below conditions must be met:

- Interested Applicants will apply for the loan through the CBN-accredited EDI,

- Interested Applicants must undergo training by a CBN-certified Entrepreneurship Development Institution (EDI),

- Fill the form with all the details required, sign, and get them authenticated by the EDI,

- Your application will then be sent to CBN through NIRSAL MFB by the EDI, for processing.

- Those who qualified will be contacted and given the loan.

Also read: List of All Nigeria Banks Transfer Codes in 2022

Requirements For NMFB/AGSMEIS Loan Application

- BVN

- A Business Plan provided by the EDI

- Details of two (2) Guarantors

- Valid ID card

- Certificate issued by a CBN-certified EDI

How to Apply For AGMEIS Loan

Follow the steps below to begin your application;

- Open the AGSMEIS loan application website Click here to Apply

- Choose if you are a new or returning applicant then click next

- Enter your BVN and click validate BVN

- Once validated, check if your details are correct, click next,

- Then, fill out the form after and click submit,

- You should receive an activation email or SMS once your application has been successfully submitted.

- Follow the link in the e-mail or SMS sent to you to finalize your application,

Also read: MTN Digital Bank – How to Open a MoMo PSB Account

NMFB Loan, loan in nigeria, free loan in Nigeria, loan in nigeria, CBN Loan, where can i get loan in Nigeria?, AGSMEIS, collateral-free loan, collateral-free loan in Nigeria,non interest loan, How to get free Loan, CBN Free loan, AGMEIS loan ,